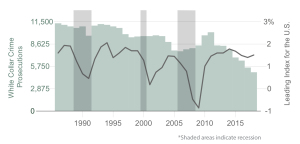

White-Collar Crime Thrives On A Frothy Economy

Scams & frauds tend to flourish during good times. Returns flow in nicely, camouflaged by overall economic prosperity, soaring markets & record real estate values. Red flags may go unnoticed until it’s too late.

Since 1990, DWC has untangled a number of frauds and Ponzi schemes in its role as a court-appointed Receiver. These crimes don’t just hurt individuals, families and businesses, but cause great harm to the wealth and resources of the nation.

“Recently, the dept. of justice charged eight individuals for manipulating futures markets and brought the largest futures market criminal enforcement action in history.”

As today’s frothy economy starts to inevitably abate, DWC is gearing up for an uptick in the discovery of white-collar crime.

Large-scale financial fraud in health care is of particular concern, with Medicare and Medicaid malfeasance in the crosshairs of federal prosecutors. Likewise, we see criminal justice resources focusing on opioid fraud and abuse detection.

Also emerging as a threat to the integrity of the country’s financial system is the illegal manipulation of securities markets. Some of the most damaging cases involve a scheme called “spoofing”: the illegal practice of placing an order for a futures contract that the trader does not intend to execute.

Earlier this year in San Diego, Deputy Attorney General Rod Rosenstein addressed the American Bar Association’s National Institute on White Collar Crime who spoke on such issues. DWC was honored to attend as newly inducted members of the National Association of Federal Equity Receivers (NAFER).