Are You Ready For The Great Wealth Transfer?

Over the next 40 years, the greatest migration of wealth in recorded history will occur. Aging populations around the world are preparing for this massive transition of personal and business assets between generations.

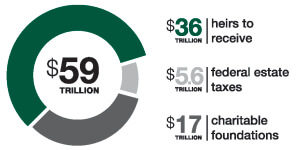

In the United States alone, an estimated $59 trillion in assets will pass from Baby Boomers to adult children through 2061.* At the peak, between 2031 and 2045, 10 percent of the total wealth in the United States will change hands every five years.** In response, Douglas Wilson Companies is expanding its services to help manage challenges presented by the biggest transfer of wealth in the nation’s history.

In the United States alone, an estimated $59 trillion in assets will pass from Baby Boomers to adult children through 2061.* At the peak, between 2031 and 2045, 10 percent of the total wealth in the United States will change hands every five years.** In response, Douglas Wilson Companies is expanding its services to help manage challenges presented by the biggest transfer of wealth in the nation’s history.

We know that the wealth-acquiring generation believed in real estate as a legacy investment. We anticipate complications as stakeholders grapple with the issues of future real property asset management, repurpose, liquidation or allocation. With our asset management and development background and our institutional expertise as a fiduciary, we can help guide families to avoid future disputes, preserve value and provide financial security for the beneficiaries in the future.

What are Legacy Assets?

Legacy Assets are those that have been created and held in ownership by individuals or entities that are poised to transfer such assets to a related, designated recipient or beneficiary. The assets are generally of significant value and have been held or created for a substantial period of time. Generally, such assets have various complications associated with them, either in the form of their management, repurpose, liquidation or allocation.

Many times such assets generate various tax consequences resulting from transition. In almost all cases, legacy asset transitions, particularly when the stakeholders are members of the same family, are vulnerable to acrimony or other negative consequences resulting from ill-planned or ill-executed management of the asset transition process.

“Parents making these critical decisions should consider the capabilities and attributes of the acquiring stakeholder,” notes John L. Morrell, “as well as the needs, desires and ongoing responsibilities associated with the assets to be transferred. This is particularly true with real estate.”

How DWC Provides Value…

DWC acts as a resource to other professionals. We work with estate planning lawyers, bank trust departments or private accounting firms to provide unique expertise based on our experience as a trusted fiduciary, combined with our unique real estate expertise. Through this expertise, we provide resources for dealing with complicated portfolio issues ranging from future governance, repurpose, redevelopment, critical management or redirection of a real estate centric Legacy Portfolio.

DWC acts as a resource to other professionals. We work with estate planning lawyers, bank trust departments or private accounting firms to provide unique expertise based on our experience as a trusted fiduciary, combined with our unique real estate expertise. Through this expertise, we provide resources for dealing with complicated portfolio issues ranging from future governance, repurpose, redevelopment, critical management or redirection of a real estate centric Legacy Portfolio.

Through our work with families and partnerships in distress, we have refined a unique process to help stakeholders and their professional advisors deal with critical issues involving their Legacy Portfolio.

The initial segment of our Legacy Service is to provide a comprehensive assessment of the Legacy Portfolio which results in an objective review of all current, present, future opportunities and constraints. This assessment will educate and support ultimate decisions made by the stakeholders with guidance from their professionals.

“When it comes to family, it’s in everyone’s best interest to avoid litigation.

The Baby Boomer generation doesn’t want to see its wealth squandered.”

For inquires please contact John L. Morrell.

* Center on Wealth and Philanthropy (CWP) at Boston College ** Accenture Consulting